april 2016 service tax rate

After levy of KKC. 8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15.

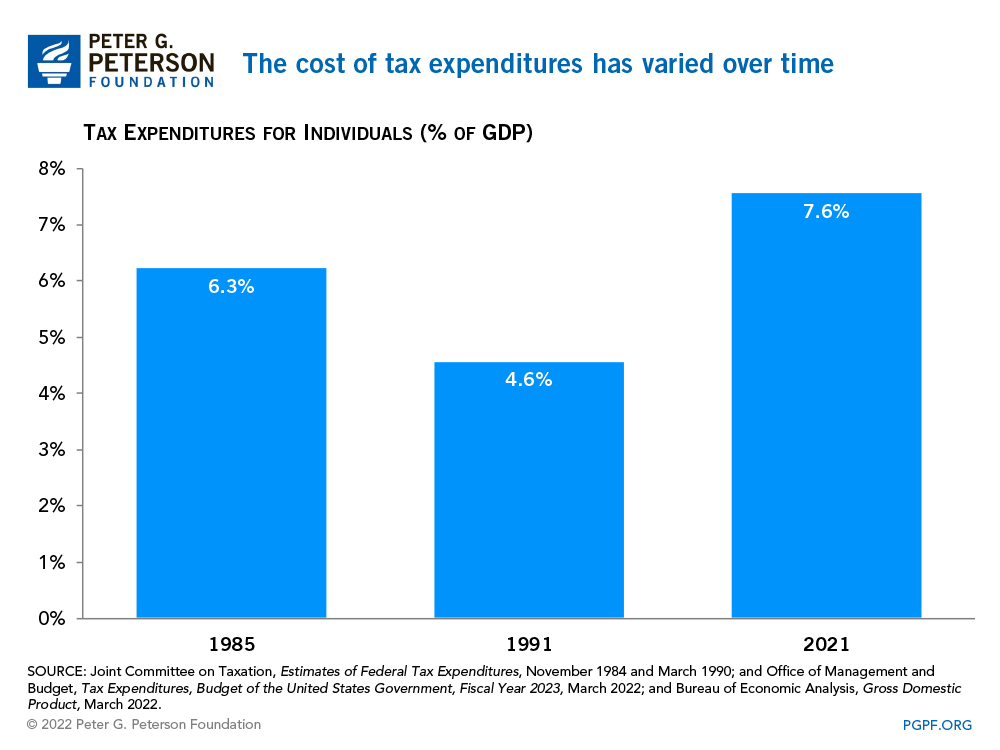

Is Corporation Tax Good Or Bad For Growth World Economic Forum

I am a service provider of repair service i have collected some amount of service tax with SBC and KKC in july-September 2016-17 from my customer by mistake not shown in 6monthly return in April to September 2016-17 till the current date 23 march 2017 what will be interest and penalty made and how to calculate to be pay on line.

. The import customs duty rate on Brussels sprouts will be decreased from 13 to 5 from 22 April 2016 to 31 May 2019 inclusive. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess. Changes in service tax Budget 2016.

Swachh Bharat Cess 05 wef. Budget 2016 proposes to reduce service tax burden on single premium annuity plans. From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods.

Cenvat credit on input input services and capital goods are not available. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act. The top tax rate of 396 now applies to single taxpayers earning more than 415050 466950 for married taxpayers filing jointlyup from the 2015 thresholds of 413200 and 464850 respectively.

Krishi Kalyan Cess is proposed to be levied from 162016 05 on the value of such taxable services. The Internal Revenue Service announced new inflation-adjusted income brackets for the 2016 tax year. The import customs duty rate on several types of almond dates and grapes will be decreased from 5 to 0 from 22 April 2016 to 31 May 2019 inclusive.

28 of 2016 the effective rate of Service Tax wef. The government notification extract also is being updated in pdf format once after release from the authorities. Cenvat credit of input services are now available.

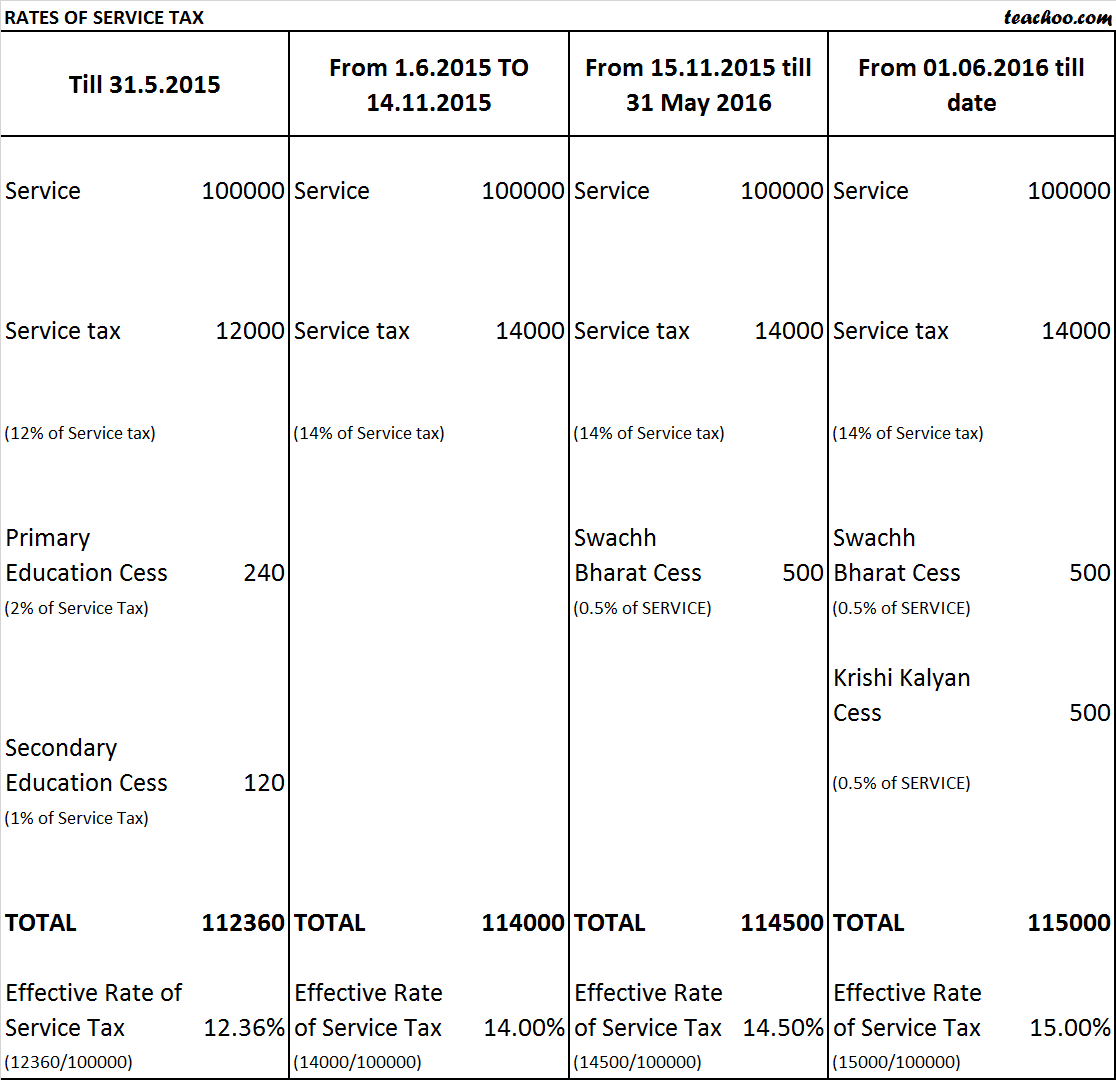

01-06-2016 is increased from 1450 to 15 14 ST 050 Swachh Bharat Cess 050 Krishi Kalyan Cess by way of introducing Krishi Kalyan Cess 050 on value of taxable services. Important Changes in Service Tax in Budget 2015-2016. 132016-ST dated 1-3-2016 effective from 14th May 2016.

Penal Rate in case of tax collected but not deposited to exchequer. INR 1000 INR 100 per day from 31st day subject to a maximum amount of Rs 20000. You may also like to read Chapter V of Finance Act 1994.

New Service Tax Rate effective from 01-06-2016 After enactment of the Finance Act 2016 No. Service Tax Basic Rate -14. 42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex building civil structure or a part thereof subject to fulfillment of the existing conditions.

The Education Cess and Secondary and Higher Education Cess shall be subsumed in the revised rate of Service Tax. In case of small service providers whose value of taxable service did not exceed Rs. New Service Tax Chart with Service Tax Rate of 15.

20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. Simple Interest Rate. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05.

If invoices are raised before June 1st 2016 for services to be provided after June 2016 then the service tax rate applicable is 14. 60 lakhs during any of the financial years covered by the notice or during the last. The service tax rate changes for Promotion of Brand of Goods Services etc under Indian Budget 2017-18 is being updated below soon after announcement of Budget on 1 st February 2017.

Simple Interest Rate 15 NOTIFICATION NO132016-ST DATED 1-3-2016 Service Tax Interest Rates on delayed payment of Service Tax in case of assessees whose value of taxable services in the preceding yearyears covered by the notice is less than Rs60 Lakh. In exercise of the powers conferred by section 109 of the Finance Act 2015 No. Thus abatement of 70 is presently available in respect of the said service.

This will be in cases where the amount allocated for. Provided also that where the gross amount of service tax payable is nil the Central Excise officer may on being satisfied that there is sufficient reason for not filing the return reduce or waive the penalty. The Said change will be effective from 1st June 2016.

Service Tax Interest Rates wef 14052016 Other than in above situations. At present service tax is leviable on 30 of the value of service of transport of goods by vessel without Cenvat credit on inputs input services and capital goods. Called the Immediate Annuity plans in the insurance industry the composition rate of service tax on single premium annuity insurance policies is proposed to be reduced from 35 to 14 of the premium charged.

If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. Awarded Global Tax and Legal Advisory Firm at Times Business Awards 2021.

The Finance Bill 2015 proposes an increase in rate of Service Tax from 1236 to 14. Invoices raised on advances before 30th May 2015 for future services could be paid at the old service tax rate of 1236. 18 rows 600.

For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess. The service tax rate may get changed by Budget 2016 from 145 to 16.

16 rows Rate of Service tax would eventually increases to 15 wef. Service Tax Rate. For the scenario till 31032016.

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Principles Relx Information Based Analytics And Decision Tools

Effects Of Income Tax Changes On Economic Growth

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pin By Pooja Bhatt On Gst India Goods And Services Tax Goods And Services Goods And Service Tax Indirect Tax

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

What Is The Rate Of Service Tax For 2015 16 And 2016 17

Rescinding Of Notifications Under Certain Sections Of Mvat Http Taxguru In Goods And Service Tax Resc Goods And Services Goods And Service Tax Indirect Tax

How Do Marginal Income Tax Rates Work And What If We Increased Them

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf Accounting Taxation Tax Payment Tax Due Date

Goods And Services Tax Economics Lessons Business And Economics Economics

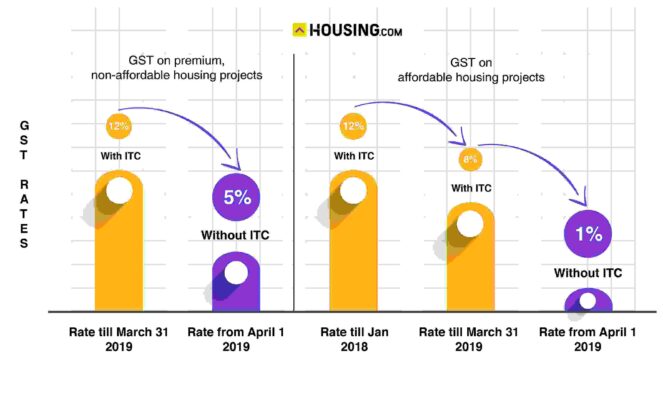

Gst On Flat Purchase Real Estate Rates In 2022 Impact On Home Buyers

How Do Marginal Income Tax Rates Work And What If We Increased Them

Gst On Flat Purchase Real Estate Rates In 2022 Impact On Home Buyers